Host of the Bob and Elvis Show

Posted: July 28, 2010 06:31 PM

We're only three months away from the midterm election when a shockingly large number of American voters will inexplicably vote for Republican candidates. I have no idea if this will mean a Republican takeover of the House or Senate or both, but there will definitely be enough voter support for Republicans to significantly reduce the Democratic majorities in the House and Senate.

Why? Because too many voters tend to be low-information, knee-jerk Springfield-from-The-Simpsons types, and the Republicans have lashed their crazy trains to this new wave of inchoate roid-rage to help sweep them into more congressional seats.

Here are a few of the ongoing economic conditions facing a vast majority of Americans, many of whom are all revved up to vote Republican in November. According to Michael Snyder of the Business Insider:

• 61 percent of Americans "always or usually" live paycheck to paycheck, which was up from 49 percent in 2008 and 43 percent in 2007.

• 66 percent of the income growth between 2001 and 2007 went to the top 1 percent of all Americans.

• Over 1.4 million Americans filed for personal bankruptcy in 2009, which represented a 32 percent increase over 2008.

• The bottom 50 percent of income earners in the United States now collectively own less than 1 percent of the nation's wealth.

• In America today, the average time needed to find a job has risen to a record 35.2 weeks.

• More than 40 percent of Americans who actually are employed are now working in service jobs, which are often very low paying.

• Despite the financial crisis, the number of millionaires in the United States rose a whopping 16 percent to 7.8 million in 2009.

Oh, and I should add, the Center on Budget and Policy Priorities reported that wages for the highest 20 percent of earners rose by nearly 300 percent since 1979, while wages for the bottom and middle 20 percent increased only by 41 percent -- combined. Plotted on a graph, middle and working class wages have flatlined for 30 years. Roll all of these tragic figures into a slow growth recovery and here we are. Most of us in the middle class are screwed.

And thanks to an alliance between the Republicans (which includes the tea party), the increasingly dominant far-right media, a traditional "old media" that panders to the far-right, and right-of-center "conservadems" who pander to the Republicans, too many voters have decided that the Republican Party might be better suited to turn all of this around.

The big lie here is that if Congress stops spending, cuts the deficit and makes permanent the Bush tax cuts, especially the tax cuts for the wealthiest Americans, our problems will be solved -- even though each of these concepts is in direct conflict with the others. Not surprising given the ever-lengthening Republican syllabus of contradictions.

Here's how this new batch of contradictions plays out.

According to Republicans and their conservadem enablers, we have to cut the deficit and pay for every program Congress passes or else we're all doomed. This has manifested itself in Republican filibusters of both unemployment benefits ($34 billion) and a new jobs bill ($33 billion over ten years). A Republican filibuster killed the jobs bill, and, after many failed cloture votes, the filibuster of the unemployment benefits was finally defeated and the Senate Democrats passed the extensions. Throughout the past year and a half, it's been the same story. Any effort made by the Democrats to stimulate the economy has been filibustered by the Republicans. They say it's because of the deficit and debt.

And yet they want to make the Bush tax cuts permanent, which would cost $678 billion dollars without paying for them -- and that's just the cost of the tax cuts going to the top two percent of earners. In other words, the Republicans want to spend $678 billion in further giveaways for the wealthiest two percent, and they don't care whether it increases the deficit.

By the way, the Republicans also recently voted against and defeated an amendment to strip Big Oil of its $25 billion in subsidies. Just thought I'd pass that along. Put another way, $678 billion in tax cuts for the wealthy? No problem. Deficit-shmeficit! But $34 billion in unemployment benefits for an out-of-work middle class at a time when companies aren't hiring (say nothing of the aforementioned bullet-points)? Evil! Instead, the Republicans want to give almost as much money to Big Oil in the form of corporate welfare during the worst oil spill in American history while telling unemployed middle class families to piss off.

Do we have a clear picture in terms of who and what the Republicans care about?

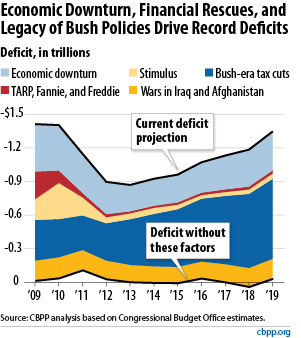

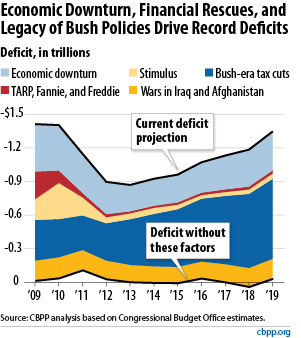

It surely isn't fiscal discipline or the deficit. And it surely isn't the middle class. The Bush tax cuts, if extended, would add $2 trillion to debt, so it's not that either. Throw in another policy started by the Republicans -- the war spending (more of which was passed yesterday without any worries about CBO scoring or making sure it's deficit neutral) -- and there's the vast majority of your deficit and debt for the next ten years. Not the stimulus or the bailouts. The long term budget impact of the wars and the Bush tax cuts literally dwarf the stimulus. The CBPP evidence in colorful graph form:

That big blue chunk represents the Bush tax cut portion of the deficit. The yellow represents the wars. The light blue is the tax revenue lost to the recession. And those really narrow tan and red strata are TARP and the stimulus. Clearly we need to elect more Republicans so they can make permanent the big thick deficit hogs and kill that thin section for the stimulus.

Now, if you're a Republican, you might be clinging to the idea that extending the Bush tax cuts would have a stimulative effect on the economy -- somehow, even though this hasn't been the case for the last ten years other than for the wealthiest Americans who have once again disproved the trickle-down theories at the heart of Reaganomics by pocketing their share of the trickle instead of reinvesting in jobs and wages for the middle class.

That won't work.

According to Moody's Analytics (hardly a left-wing apparatchik), for every dollar of government money spent on extending the Bush tax cuts, there's only a 32-cent return on investment in terms of economic stimulus. Not a solid investment. How about cutting the corporate tax rate? Also a 32-cent return in economic stimulus. Capital gains tax cuts? 37-cents. And, lumped together, there's your Republican plan for recovering the economy. Dumb investments. Goldman Sachs would short these policies. I'm not sure they haven't, actually.

But what about the Democratic spending? For every dollar spent on unemployment benefits, there's a $1.61 return in economic stimulus. Good investment! How about infrastructure spending? $1.57 return. Aid to the states? $1.41. Temporary increase in food stamps? $1.74. Even the Obama tax credits for the middle class, $288 billion of the Recovery Act, account for up to $1.30.

Meanwhile, the Obama administration is working with a deficit commission which will focus on trimming the deficit after (we hope) the economy and jobs are back on track. The Republicans, of course, voted against forming a deficit commission.

Given the choice between deficit spending that significantly stimulates economic growth and deficit spending that barely makes a dent, which choice are the Republicans trying to sell? The really stupid deficit spending that barely makes a dent. That's the Republican plan.

Also, contrary to popular far-right myths, it's worth noting that the Democrats and the White House have no intention of allowing the tax cuts for families earning less than $250,000 to expire. Those tax cuts will be renewed this year. As for the top tax brackets, you find me a multi-millionaire who pays the actual marginal rate every April and I'll show you a very rich moron. Most of these guys, after deductions and loopholes, pay an effective tax rate that's much lower than the middle class tax brackets. So don't tell me that millionaire Glenn Beck and millionaire Paris Hilton will be financially burdened by a 2.6 percent bump in their margin tax rate next year. Sorry, no. They won't be. And why do middle class Republican voters give a rip about Paris Hilton's tax rate? Because they believe they'll be as wealthy as Paris some day. But read those bullet-points again. It's not happening.

Unless there's some sort of mass epiphany, or unless the Democrats actually speak up and take the discourse by the horns and fight, middle class American voters in November will augment the number of Republicans (and conservadems) in Congress mostly because they've been suckered into endorsing these insane Republican economic policies. Subsequently, the Republicans will balloon the deficit and undermine the economic recovery in order to give more handouts to the super rich. And the middle class will continue to be an accomplice in its own slow-roasted homicide.